| by Dan Mitchell |

I recently explained the evolution of taxation – and the unfortunate consequences of income taxation – to a seminar in the country of Georgia.

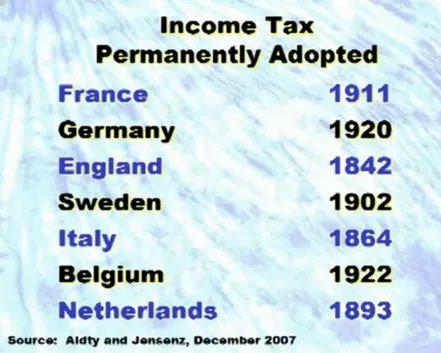

One of my main points was that income taxes are a relatively new source of revenue.

The first income tax was adopted in the United Kingdom in the mid-1800s and other nations followed over the next 50-plus years (the United States joined that unfortunate club in 1913).

And, as noted in the video, income tax enabled a massive expansion in the burden of government spending.

In a column for the Foundation for Economic Education, Martin Litwak explains how the U.S. and U.K. made the mistaken choice to impose income taxes.

…income tax is a rather recent “invention,”… Income Tax was first introduced by William Pitt in the United Kingdom in 1798, and it started to be charged in 1799. The aim was not to finance original expenses of the State but the Napoleonic Wars. …It was kept in force until the Battle of Waterloo. When the tax was annulled again, every document that referred to it was burnt, due to the sense of shame associated with having established and charged this tax. …Prime Minister Robert Peel reestablished it in 1841, not to finance a war but to cover the Government’s deficit. …the United States became independent from the United Kingdom in 1776…the country imposed the first income tax…to finance…the Civil War. …In 1872, the income tax was annulled, basically due to the pressure of taxpayers, who deemed it expropriatory… In 1894, the income tax was incorporated again, but the next year, …the Supreme Court declared it unconstitutional. …In 1909, the creation of this tax was proposed again… The 16th Amendment was introduced precisely to achieve this goal.

A sad column.

But it gets worse because politicians also then imposed payroll taxes.

Then they imposed value-added taxes.

Both of which helped to finance further expansions in the burden of government spending.

The bottom line is that it’s never a good idea to give politicians a new source of revenue.

Especially new taxes that are capable of generating a lot of revenue (or a medium amount or small amount of revenue).

P.S. Interestingly, many early advocates of income taxes in the U.K. and U.S. were not trying to finance a big welfare state, but rather wanted a new revenue source so they could lower or eliminate protectionist taxes on imports.

The moral of the story is to be careful of unintended consequences.

P.P.S. If you enjoyed watching a video about the history of the income tax, here’s a (much longer) history of economic policy in the 20th century.